If you’ve recently purchased a Gala Games node, you may be wondering how these earnings will be taxed. And if you aren’t, you should be. Not fully understanding how crypto is taxed – especially given the volatility in the market and corresponding potential for big gains and big losses – can cost you a lot of money in taxes.

I’ll provide some background below, but the short answer is that under current IRS guidance:

- Gala node earnings would not be taxable until they are minted

- Your holding period for capital gains purposes does not begin until the tokens are minted

- Your taxable income upon minting the tokens becomes your starting cost basis for when the tokens are sold

All of this is to say that as the US government continues to grapple with these issues and issues new rules and regulations, this guidance may change.

But under that current guidance, the tokens actually being minted appears to be the controlling factor. This has to do with a concept known as “domain and control”. That means the full and actual possession of the asset and ability to use it.

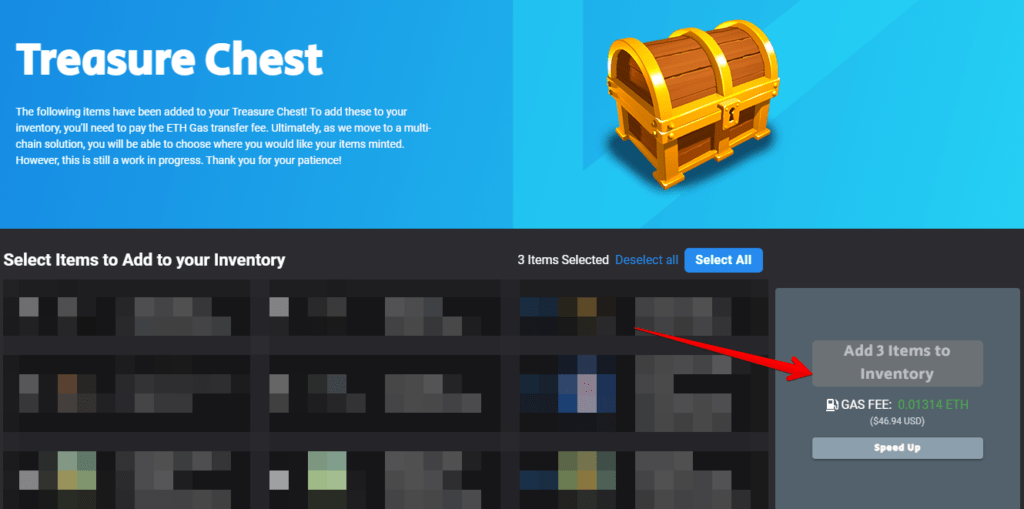

As it relates to crypto, that would be when you mint it. With gas fees as high as they are, it’s not unreasonable to argue that those costs are prohibitive to you being able to gain domain and control over your unminted tokens. It’s the reason many node owners are not minting their tokens and are instead accruing them in their treasure chests.

In Rev. Rul. 2019-24, the IRS was asked if taxpayers needed to claim income from hard forks and airdrops. It noted:

“A taxpayer does not have receipt of cryptocurrency when the airdrop is recorded on the distributed ledger if the taxpayer is not able to exercise dominion and control over the cryptocurrency. For example, a taxpayer does not have dominion and control if the address to which the cryptocurrency is airdropped is contained in a wallet managed through a cryptocurrency exchange and the cryptocurrency exchange does not support the newly-created cryptocurrency such that the airdropped cryptocurrency is not immediately credited to the taxpayer’s account at the cryptocurrency exchange. If the taxpayer later acquires the ability to transfer, sell, exchange, or otherwise dispose of the cryptocurrency, the taxpayer is treated as receiving the cryptocurrency at that time.”

That’s great because it defers the taxable income until you actually mint the tokens. But it’s not without its downsides.

The taxable income you report is the FMV (Fair Market Value) of the tokens you are minting – basically the market price of the tokens multiplied by the number of tokens being minted. The higher the token’s value, the higher the amount of taxable income. Importantly, this also becomes your cost basis.

Let’s run through a few examples. “John” and “Steve” both have 100,000 Gala tokens. John mints his when the token was worth 1 cent while Steve waits until it’s worth 10 cents. They both sell when the token is 12 cents.

Upon minting the coins, John is hit with $1,000 of taxable income ($0.01 x 100k) and Steve is hit with $10,000 ($0.1 x 100k).

That’s a big difference in the initial tax hit. But it is partially offset once the tokens are sold because of the differences in cost basis.

When John sells his Gala, he is going to have capital gains income of $11,000 ($12,000 sale price minus his cost basis of $1,000). When Steve sells his Gala, his capital gains are $2,000 ($12,000 minus $10,000 cost basis).

Ultimately both end up with $12,000 in taxable income, it’s just a difference of timing and what type of income the earnings are classified as.

That’s not to say that the type of income does not matter. Assets that are held for more than once year before being sold are taxed as long-term capital gains, which receive a much lower tax rate than ordinary income.

And that holding period does not begin until you acquire possession and control of the asset – which again means when you mint it. So even if you are planning to buy and hold, there are times where it may make sense to mint the tokens to get the clock ticking on your holding period.

As with anything tax related, these things are complicated and can vary greatly based on your individual situation. Plan for this carefully with your CPA throughout the year, otherwise you may end up with a nasty surprise come tax time.

Any accounting, business, or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.